The term “greenwashing” is not a recent one. As early as 1986, environmentalist Jay Westerveld used this term to describe his experience in the Fiji Islands. The hotel on the island communicated to protect the coral reef by suggesting that customers reuse towels: but the purpose of the hotel was to save costs. Jay calls “greenwashing” the act of pretending to protect the environment when the main purpose is to increase profit.

The green bond market

Green finance has grown a lot in recent years: the idea is to allocate funds at low costs to finance projects that have a positive impact on the environment. Environmental risks are constantly changing, hand in hand with climate change, creating an ever higher demand for investments that finance sustainable projects and positive environmental impact.

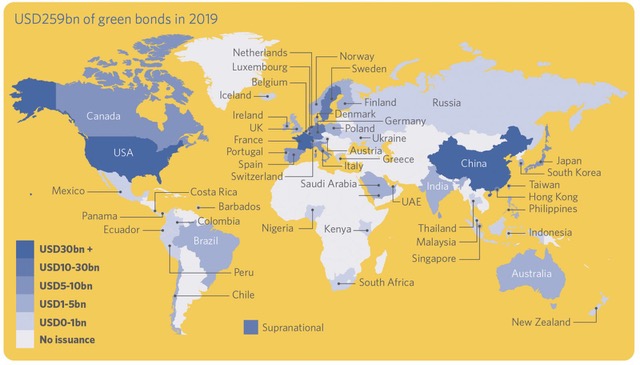

The market for certified climate bonds alone has largely exceeded 150 billion dollars in terms of emissions. If we talk more generally about green bonds, on the other hand, about 259 billion dollars were issued in 2019 alone.

The risk of greenwashing

Greenwashing in finance means using these funds to finance projects that have little or no environmental benefit. How is it possible? Let’s start to clarify the concept right away: there are associations that have created high standards to verify whether a given bond issue is in line with the Paris agreements. If the bank that acts as an intermediary between the issuer and the market to issue the bond (it is said that it “places” the bond) also involves these third-party associations (therefore extraneous and independent from the issuer or the bank that places them), in the case of positive outcome of the analysis the bond receives a certification of conformity (Certified Climate Bond).

As we can see, however, from the numbers above, only a percentage of “green” issues are certified, because the decision whether to have the bond issue certified or not is optional and not mandatory. On some projects the criteria are probably met even if not certified, but probably not on all. In fact, this is a case of financial greenwashing: I can associate the term “green” with my company given the sensitivity of the market on the subject even if the funds raised will be used for my normal operations, no more and no less than I did before.

What can we do?

Are you making green investments or are you getting information to make them in the future? Our savings, even if individually limited, put together are the basis for future bond issues: it is thanks to these savings and investments that the funds buy the green bonds and therefore in a chain that the companies decide to issue a green bond to finance a sustainable / positive environmental impact project. It is therefore also up to us to request more precise information regarding our investments.

You can start by doing some simple checks.

Is the bond certified? It is the greatest certainty you can have on the goodness of the project because it is also controlled by an external and expert entity.

Who is the bank that places / underwrites it? If the bank involved is renowned for being very active in the certified green bond market, it probably has a selective process in place that it maintains even if the issuer did not want to certify that particular bond.

Do you invest in a mutual fund? Sometimes we don’t just invest in a bond, but rightly diversify the risk by investing in mutual funds: we therefore leave it to the manager to choose the best instruments for us to use. How do you check that the fund is investing in sustainable instruments overall? Here, too, the ratings of third-party agencies come to our aid, such as the Morningstar sustainability rating, which in a direct and simple way gives us an indication of how sustainable that fund is by giving a number of globes from zero to 5. Just take the name fund or its identification number (ISIN) and check the Sustainability Rating on the Morningstar website.

The next time you talk about investments with those who follow you, also ask how sustainable they are and if the emissions are certified: sometimes the changes have to come from below for the entire industry to start changing its standards.