For a couple of years now, the acronym ESG (Environmental Social and Governance), synonymous with “sustainable”, has become one of the most widely used. But do ESG investments exist in Italy? To answer this question, we need to consider investors on the one hand and issuers of sustainable financial instruments on the other.

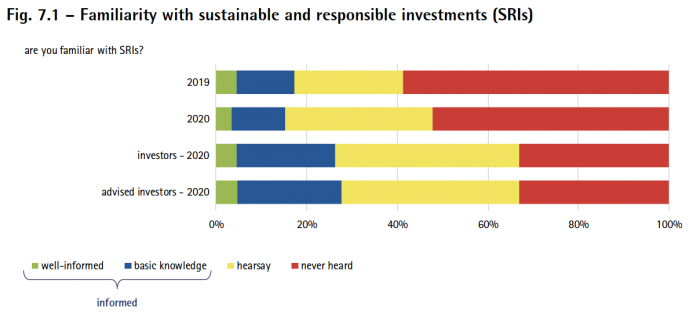

The 2020 Report on Investment Choices of Italian Households, an annual study by Consob (the Italian securities regulator), provides a snapshot of the situation in Italy. In the section dedicated to sustainable investments we have to reckon with a lack of knowledge of what the term “sustainable and responsible investments” means on the part of Italian households: in fact, in general less than 18% of the sample is well informed or has a basic knowledge of this type of investment in 2020.

The situation is a little better among those who invest: in this case the percentage is 10% higher, but still below the 30% threshold, decidedly little compared to the evolution of the market. In fact, there is a significant percentage of investors (almost 35%) who have never even heard of it.

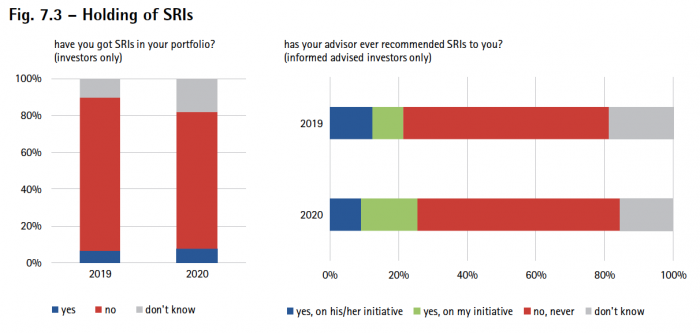

The percentages actually invested in ESG investments also remain very low, as we can see from Figure 7.3 below (blue area of the first graph), although there is growing interest, especially from investors themselves, who are taking the initiative and asking their financial advisor to invest in precisely this type of instrument.

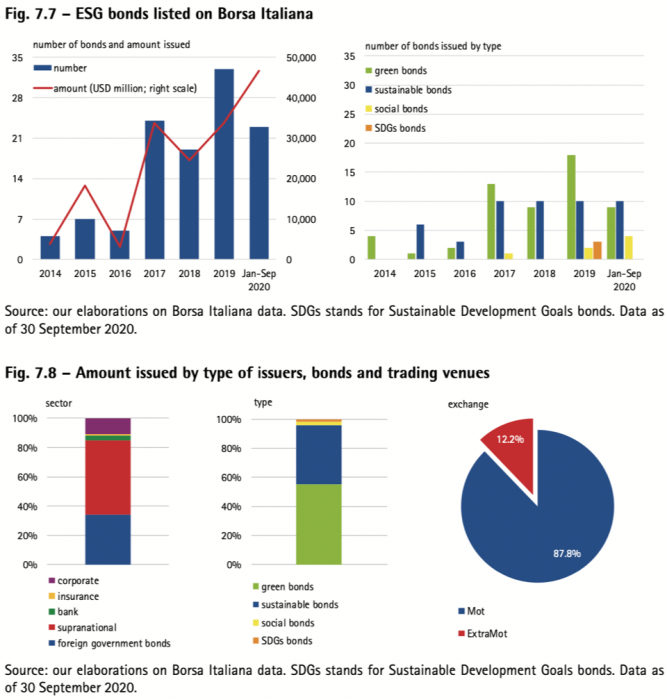

And what about issuers? In 2020, the issuance of ESG bonds surveyed by Borsa Italiana accelerated sharply (Fig. 7.7 – 7.8). Issuers are mainly represented by supranational organisations, while the involvement of the private sector seems, unfortunately, still rather limited; in fact, Italian companies are not very relevant in terms of the amount issued. These securities are almost all listed on the MOT (Mercato Telematico delle Obbligazioni) market of Borsa Italiana, sometimes with minimum issue denominations (€1,000).

In conclusion, Italy is still lagging behind the rest of Europe in terms of both the volume of ESG/sustainable instruments issued and investors’ awareness of them. Fortunately, the trend is one of strong growth in both areas, thanks in part to the efforts of those seeking to provide information on these important issues.